Compliant • Secure • Scalable

Payments initiation & orchestration - Canada‑hosted, partner‑settled.

What We Offer

One Platform. Compliance‑First.

Global Services

Currency exchange, remittances, merchant payments, IBAN via partners

Compliance‑first operations

FINTRAC‑registered Canadian MSB, AML/ATF, KYC/KYB, monitoring

Canada‑hosted

AWS ca‑central‑1), PCI SAQ‑A

(no PAN storage)

How It Works

Payment Initiation & Orchestration

- Initiate/transmit EFTs via regulated acquirers/PSPs

Refunds/payout requests routed to partners

FX & IBAN via partner institutions

No custody of end‑user funds; no wallets

PSP Orchestration

No Custody, No Stored Value

We initiate & transmit EFT instructions; partners authorize/settle

No wallet/stored‑value: CAD 0 end‑user funds held

Clearing/settlement done only by partners

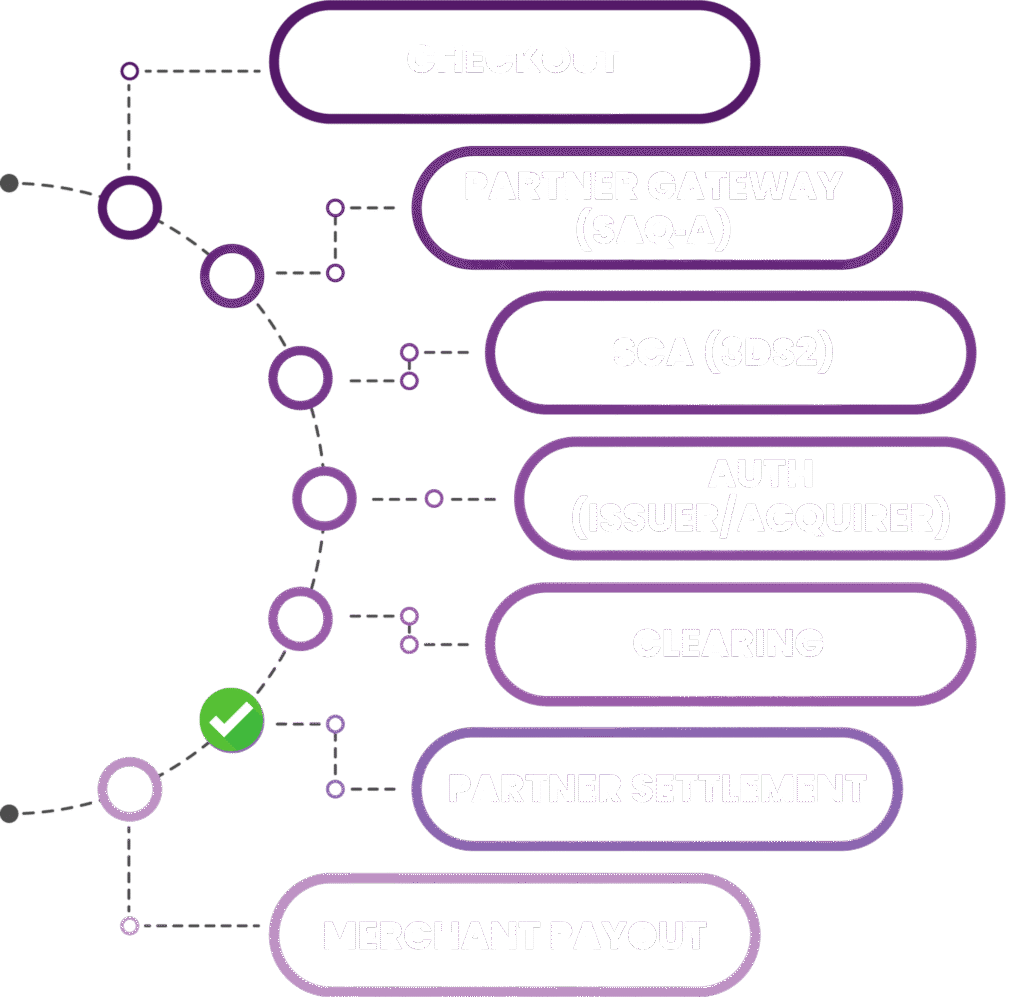

The Process

Checkout to settlement at a glance

Common Questions

Risk-Based Compliance & Onboarding FAQ

These FAQs provides clear answers about our risk-based onboarding process, ongoing compliance measures, and audit-ready recordkeeping to ensure regulatory standards and partner eligibility are consistently met.

Our process includes pre-screening, sanctions and PEP checks, KYB (Know Your Business) pack, UBO (Ultimate Beneficial Ownership) KYC/IDV.

We implement adaptive risk scoring and enhanced due diligence for all partners and clients.

We provide ongoing monitoring of partner eligibility, contracts, and technology integration to ensure compliance.

Yes, we follow FINTRAC/PCMLTFA AML programs and have dedicated independent compliance leads.

We keep records for over 7 years and maintain robust transaction monitoring, sanctions/adverse media checks, and mandatory training.